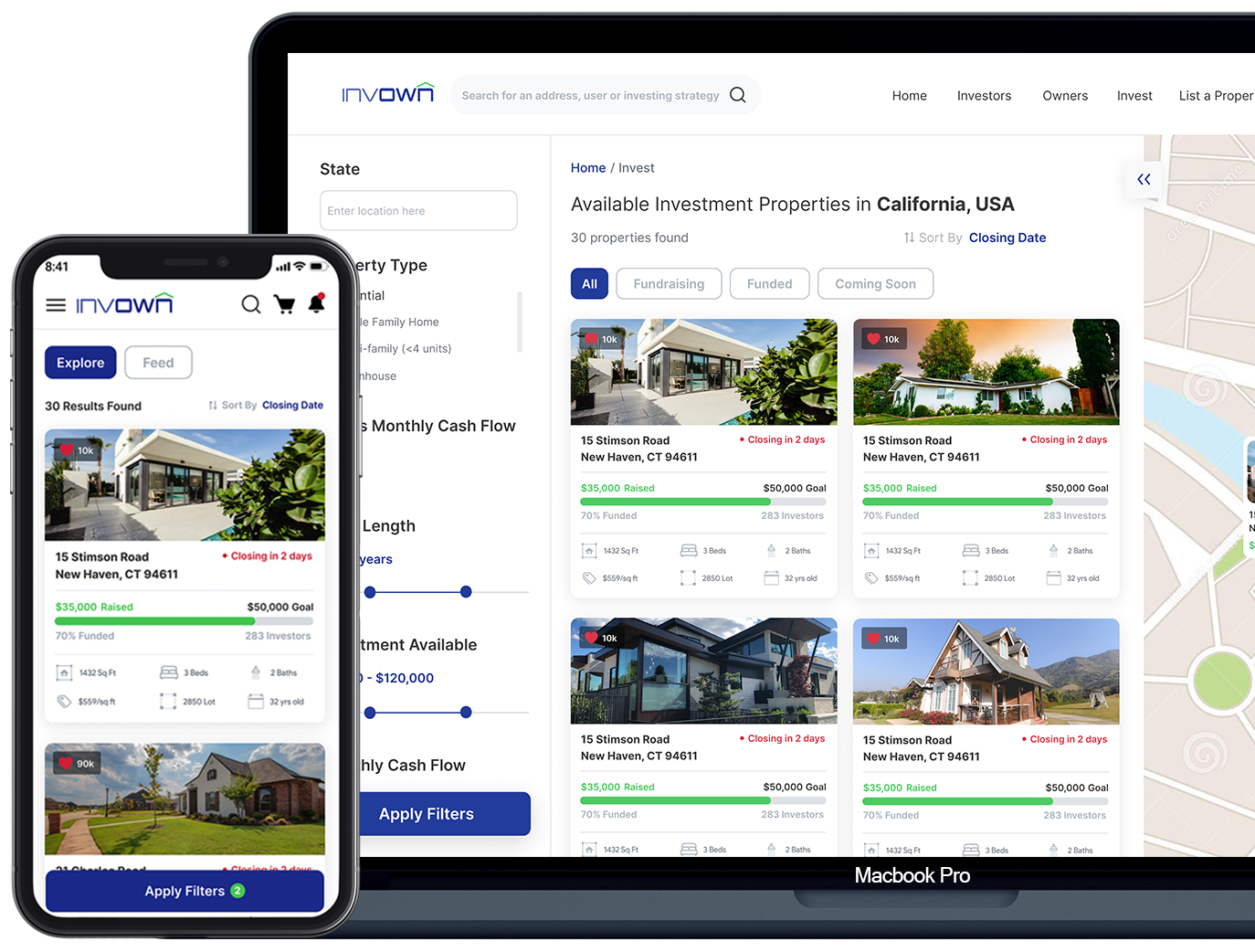

Raise equity capital from everyday investors

Raise Funds From Anyone

Streamlined and Easy

All Types of Real Estate

You Set the Terms

Using Reg CF you can raise funds for your real estate, deal backed by the property’s equity, from anyone.

Invown helps you every step of the way, we even provide lawyer vetted templates to streamline the creation of legal documents

Invown supports all property types – single family, multifamily, manufactured home communities, office and industrial, retail and self-storage.

When you Invown you’re in the driver’s seat. You set the terms of the offering to investors — not the other way around.